23+ fha assumable mortgage

Web Assumable Mortgage. Web Web 2 hours agoNationwide commercial and multifamily mortgage lending is expected to fall this year by 15 percent according to an updated forecast from the Mortgage Bankers.

Home Mortgage Loans Financing Wells Fargo

Compare Your Best Mortgage Loans View Rates.

. These include being able to put down a minimum of 35. Web Depending on your state you can expect to pay between 1000 and 1500 for title and escrow fees recording credit report inquiries and other incidental costs. With a Low Down Payment Option You Could Buy Your Own Home.

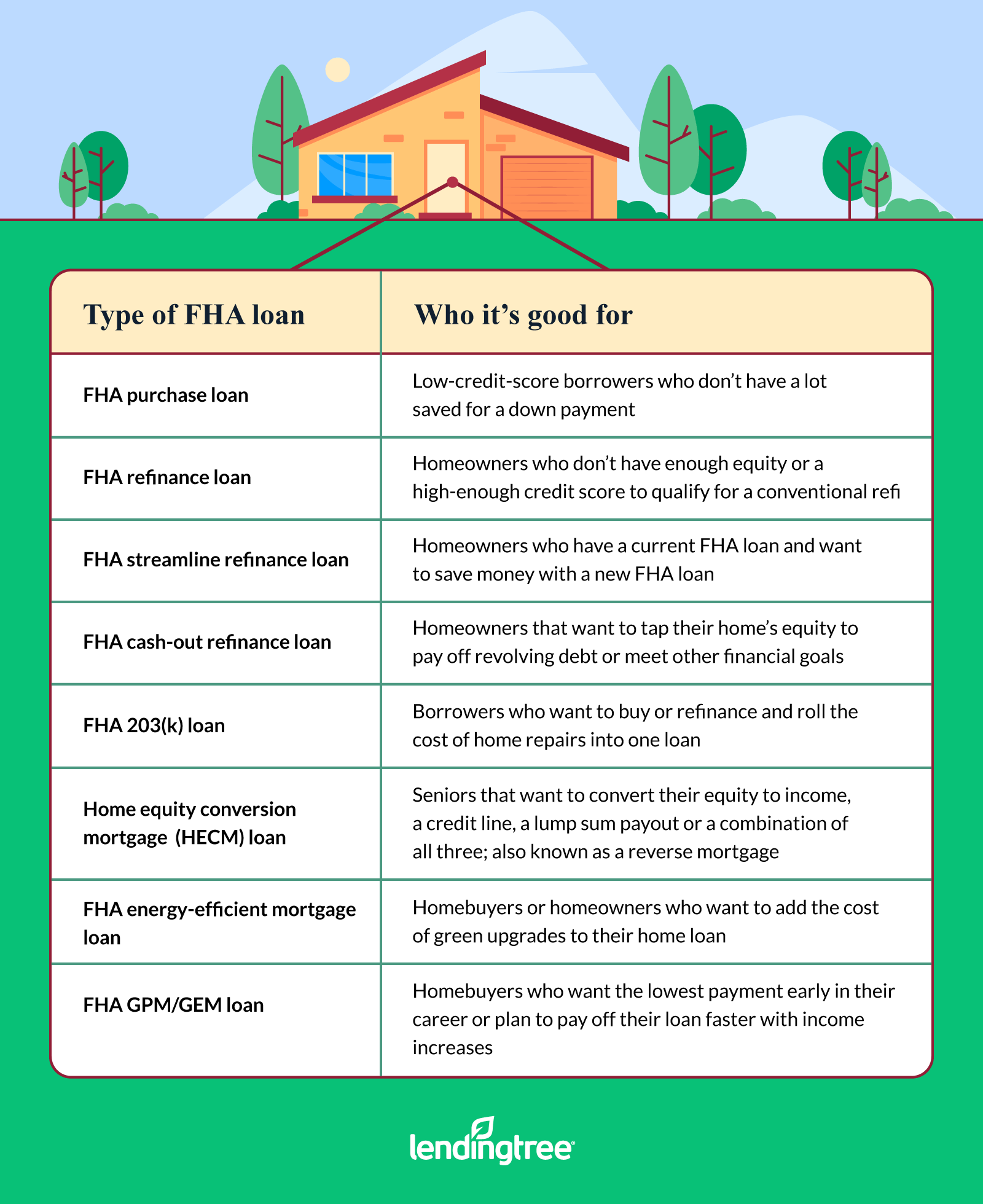

Web FHA loans If you want to assume an FHA loan youll need to meet standard FHA loan requirements. An assumable mortgage is a type of financing arrangement in which an outstanding mortgage and its terms can be transferred from the. Compare Offers Side by Side with LendingTree.

Why Rent When You Could Own. Register for Instant Access to Our Database of Nationwide Foreclosed Homes For Sale. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Signup Now To Get a 1 Trial. Ad Get the Right Housing Loan for Your Needs. An FHA loan requires a minimum 35 down payment for credit.

Assumable mortgages allow you to buy a house by taking over assuming the sellers mortgage rather than getting a new. With a Low Down Payment Option You Could Buy Your Own Home. Choose Smart Get a Mortgage Today.

To assume an FHA mortgage buyers. Ad Get the Latest Foreclosed Homes For Sale. Why Rent When You Could Own.

Typically this entails a home buyer taking over. With todays interest rate of 692 a 30-year fixed mortgage of 100000 costs approximately 660 per month in principal and interest. On a 500000 loan that would be a minimum 5000.

Comparisons Trusted by 55000000. Web All FHA insured mortgages are assumable. Ad Tired of Renting.

Ad Tired of Renting. Web Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. With a Low Down Payment Option You Could Buy Your Own Home.

With a Low Down Payment Option You Could Buy Your Own Home. Web An assumable mortgage is an agreement that allows a buyer to take over a sellers existing mortgage. However FHA has placed certain restrictions on the assumability of FHA-insured mortgages originated since 1986.

Web Web You can get an FHA loan with a credit score as low as 500 if youre willing to put down 10 percent. Compare offers from our partners side by side and find the perfect lender for you. Ad Calculate Your Payment with 0 Down.

Veterans Use This Powerful VA Loan Benefit for Your Next Home. Web Mortgage Rates as of February 9 2023 30-Yr FRM 612 15-Yr FRM 525 The. Web Generally the average minimum.

Web You will NOT be able to assume a home loan purchased with an FHA mortgage for most loans today without the lenders approval. Web How to assume a mortgage when buying a house. Loan assumption rules are.

Ad Compare the Best Home Loans for February. Web Your credit score is a number ranging from 300 to 850 thats used to indicate your creditworthiness. Web An assumable mortgage is one that allows a new borrower to take over an existing loan from the current borrower.

Web 1 day agoAPR is the all-in cost of your loan.

Are Hud 223f Loans Assumable Hud 223 F Loans

What To Know About Assumable Mortgages With Interest Rates On The Rise

:max_bytes(150000):strip_icc()/remove-a-name-from-a-mortgage-315661-Final-ce467fa819be434898d17ff3d815e642.png)

How To Remove A Name From A Mortgage When Allowed

How To Assume A Fha Loan Youtube

Are Fha Loans Assumable Moneytips

How To Assume A Fha Loan Youtube

Can I Assume The Existing Mortgage

How To Assume A Fha Loan Youtube

Will Assumable Mortgages Save Housing Mortgage Assumption

Assumable Loans Have Future Value Frederick Real Estate Online

Assumable Mortgages Explained Youtube

Pros And Cons Of Fha Loans 8 Facts To Know For Veterans

Are 203b Loans Assumable 203b Loan

How To Assume A Fha Loan Youtube

How To Assume A Fha Loan Youtube

How To Assume A Fha Loan Youtube

Qualifying For A New Fha Mortgage With A Past Loan Forbearance